Business Development Consultants

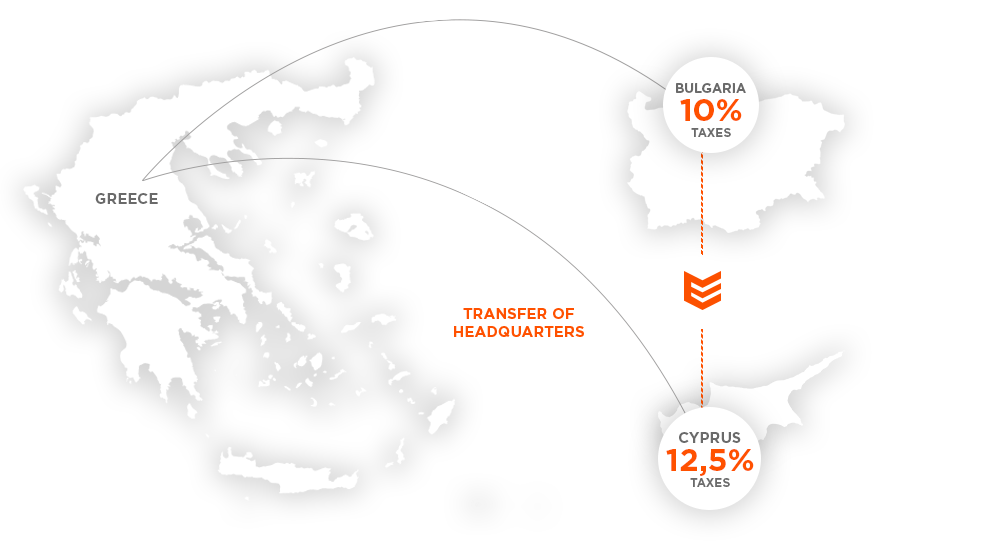

Tailored Tax Planning in Greece, Cyprus and Bulgaria

Business WorldWide

Establishment of companies and presence with offices in 3 countries

Epidosis is active in Greece, Cyprus and Bulgaria providing personalized tax planning services with a strong advisory character for more than 30 years.

Our extensive involvement with these markets has equipped us with unparalleled experience and the necessary expertise to help you realize your business venture with the highest possible degree of success.

Which country to choose?

Branch of a Greek company

from Greece to Cyprus or Bulgaria

Expand in Greece

Establishment of companies and presence with offices in 3 countries

EPIDOSIS is a company providing specialized consulting services that comprehensively supports the stability and growth of each of your businesses.

Our main pursuit is the high level of financial services, in environments that encourage growth and are business friendly. More specifically, we provide you with:

- Personalized Tax Advisory Services

- Advisory services

- Accounting Services

- Internal Audit – Tax Audit Process

- Payroll management of companies

About us

EPIDOSIS provides high quality accounting services for all businesses. In EPIDOSIS our staff has the necessary scientific knowledge, training and experience to provide the best possible services.

The modern commercial and business environment is characterized by intense volatility, challenges and several peculiarities. The constant diversifications of the economic and business environment are a major factor

The modern financial environment is creating increasingly complex risks and more challenges for all businesses operating locally.

Funding programs embody a new philosophy allowing the combination of subsidies and banking tools to implement any investment project. At EPIDOSIS, as Business Development Consultants, we assist in the planning…

Why Epidosis?

We have the necessary experience to organize and implement your business idea.

We offer complete solutions, from the establishment of a company to its legal representation.

We tailor our tax planning to your specific needs in order to achieve the right result.

Our considerable experience in setting up a company abroad is our passport to ensuring that your new venture is a complete success.

Our Blog

1. What are the comparative advantages of a Bulgarian company compared to a Greek company? A Bulgarian company ensures that 90% of net profits…

EPIDOSIS is a company providing specialized consulting services that comprehensively support the stability and growth of business esa in the following areas: 1. Tax…

Our Philosophy We provide high-standard legal services tailored to the specificities of each case, building a relationship of trust with our clients. With specialized…

In the modern era of Artificial Intelligence and the rapid evolution of information systems, with all the changes brought by the COVID period in…